What is a Credit Score And Credit Report- Important Guidelines For CIBIL- GUIDELINES WHEN WRITING A CREDIT REPORT

You have probably heard of the word “credit report” and couldn’t make any reasonable meaning from the term. In this article, we’ll take you through all the information you need to know about the credit report.

And that’s not all…

We’ll also take you through the guidelines when writing to request your credit report.

What is a Credit Score?

A credit score is a numerical expression based on a level analysis of a person’s credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus.

Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Lenders also use credit scores to determine which customers are likely to bring in the most revenue. The use of credit or identity scoring prior to authorizing access or granting credit is an implementation of a trusted system.

Credit scoring is not limited to banks. Other organizations, such as mobile phone companies, insurance companies, landlords, and government departments employ the same techniques. Digital finance companies such as online lenders also use alternative data sources to calculate the creditworthiness of borrowers.

WHAT IS A CREDIT REPORT?

In the financial world, a credit report is a buzzword which persons conducting financial transactions should be aware of. Simply put, a credit report is a financial tool or record used by financial institutions to determine the credit or debit worthiness of an individual. A credit report captures an individual’s identity information, credit card and loans accounts, current balances, payment information, and default. On a regular basis, it is required for financial institutions, including, banks to request the content of a credit report from a credit bureau. In addition, a credit report also captures the credit score of an individual. A credit score is the summary (numeric) of an individual’s repayment history.

In order to get a bank to approve your loan request, it is important that you maintain an excellent credit score. Once a bank finds your credit score to be good, the bank won’t waste time in approving your loan request.

The reason is that banks and other financial institutions that make use of the credit report use the score to assess the ability of the loan applicant to diligently repay back the loan with interest. Loan applicants with a bad credit score are more likely to be rejected or offer a loan with a high-interest rate.

Therefore, if you know you’ll need a loan to solve your financial imbroglio, then ensure you maintain a good credit score.

Once in a while, you can request your credit report to check and see your performances. In the event that you notice any discrepancy, it is within your right to demand reconciliation, so that the errors can be corrected.

Now, let’s take you through some fundamental points and guidelines you should be aware of when applying for a CIBIL as a first timer.

IMPORTANT POINTS AND GUIDELINES WHEN APPLYING FOR A CIBIL

- India has three (3) credit bureaus which are saddled with the responsibility of maintaining the credit report of individuals. The bureaus are – Experian, TransUnion, and Equifax. Each of these bureaus operates independently of the other. When calculating your credit score, they have their peculiar proprietary algorithms. When lenders want information on the repayment ability of an individual, they send request to any of the credit bureaus to supply them with such information. Hence, it is ideal to check your information from the three credit bureaus and not just settle for a single bureau. Here’s how to do it. Spread the request for your credit report for a financial year. With this, you will be able to check your credit report with each of the bureaus every 4 months within the year.

- The Reserve Bank of India, the country’s regulatory banking authority has directed the three bureaus to ensure that they supply one free report to individuals based on request or application. Therefore, each year, you can obtain a free credit report from any of the three credit bureaus.

- The application process is seamless. When you visit a credit bureau’s website, the process is clearly displayed. You can do the application either online or download the application form, fill and submit. The required documents are:

- Photo ID

- Proof of Address

- Date of birth certificate

- PAN Card number

Applying online is a faster process and you would get to track your application status for free. Applying offline is kinda slow because you’ve got to attach the above-listed documents with the application form, and then send them through a post office. However, we advise you to order for your credit report online.

- The credit bureaus have a system in place that automatically captures your information from lenders. However, the process is still fraught with irregularities and errors, hence errors may appear on your credit report. Therefore, it is expedient on you to scrutinize every part of the report to ensure that you get an accurate report.

- Important information to scrutinize are as follows:

- Personal details

- A loan account against your name which you didn’t request for

- A valid loan account even though you’ve completed the repayment

- Error balance in your loan accounts

- Total amount on credit cards

- Credit enquires

- Credit utilization ratio

- Amount overdue statement

- In the event that you discover an error in the report, you can dispute the report. The dispute process can do done online. All you have to do is to visit the bureau’s website, download a dispute form, fill the form, and then submit the form online. You will use your personal information and the control number which was assigned while generating the report to file the dispute. Once the bureau gets your dispute, they will check and correct the errors with the lender. Please be aware that it takes about 30 to 45 days to get your dispute resolved.

The issue of credit report should be taken seriously. Regardless of the nature of discrepancies observed in your credit report, it is important that you follow up the dispute resolution process with seriousness. What’s more? an error in your report may even result to identify theft. So, take it upon yourself to review your report at least once in a financial year. Ensure your credit score is accurate and healthy because it forms the basis which lenders use to calculate your creditworthiness.

WHAT A CREDIT REPORT SCORE MEAN

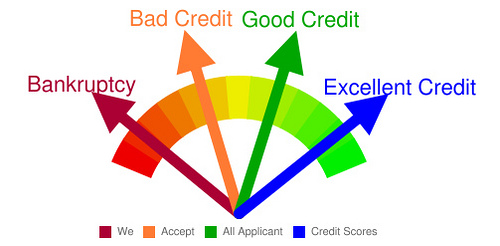

After requesting and obtaining your credit score, the next question that most people normally ask is the implication of the score. Our guidelines below will help you determine what your credit score stand for. As we earlier mentioned, a credit score is a number usually between 0 and 900, which is used to determine your credit or debit worthiness.

- Below 300: A score below 300 shows that you have a bad credit standing (ability to repay back loans). Lenders may not honour your request for a loan.

- 300 to 449: A score between 300 and 449 is what financial analyst term “a poor credit standing”. If you are already on an existing loan, ensure you do not miss a repayment.

- 450 to 599: A score within 450 to 599 is accepted by some financial institutions, not all. Your card or loan request might be given consideration with this score.

- 600 to 749: A score within 600 to 749 is considered good. Most banks will approve a loan or card request on this score.

- 750 to 900: Financial experts assert that a credit score within this range is excellent. It means any individual having this score would promptly repay any loan with interest. No bank will want to turn down a loan request from an individual with a score within this range.

FACTORS THAT CAN BRING DOWN YOUR CREDIT SCORE

The following are the factors that can reduce your credit score:

- Late payment of credit

- Ignoring your card bill dues

- When banks use debt collectors to retrieve credit from you

- Bankruptcy

- Credit card closure request

- Requesting for multiple loans or credit cards

- Failure to correct errors in your credit report

- Failure to routinely check your credit report