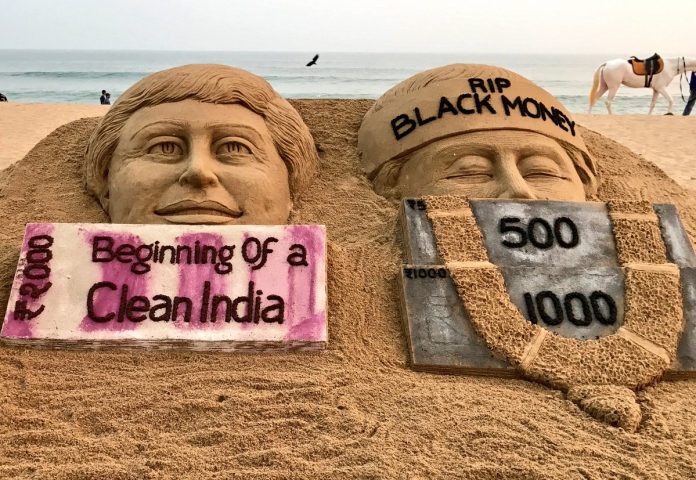

DEMONETIZATION IN INDIA

Narendra Modi, The Prime Minister of India , announced the demonetization at 20:00 Indian Standard Time (IST) on 8 November 2016, where he declared that use of all ₹500 and ₹1000 banknotes of the Mahatma Gandhi Series would be invalid past midnight, and issuance of new ₹500 and ₹2000 banknotes of the New Series in exchange for the old banknotes. Earlier, demonetization of 1,000, 5,000 and 10,000 rupee notes was done by the then Prime Minister, Morarji Desai in 1978.

Pros:

- Drastically affected the corrupt practices.

- People who are holding black money in cash will not be able to exchange

- Counterfeit currency and terrorism did not be able to continue it further for quite some time at least.

- The banking system will improve as it will slowly head towards a cashless society.

- Cashless society will increase credit access and financial inclusion. The

- Fall in Inflation.

- Reduction in the risk and cost of cash handling as soft money is safer than hard money.

- It will also reduce tax avoidance.

- Tax and interest rates on loans may come down as higher income tax collections arising from better compliance have offer scope to reduce rates over the long term.

Cons

- Real estate, jewellery, retailing, restaurants, logistics, consumer durables and luxury brands, cement and some segments in retail/SME lending space is facing short term instability.

- Added replacement costs of currency.

- For these initial months, it was very difficult to make cash transactions of a higher amount.

- Further, the penal provisions were hefty enough to ensure that corrupt practices will find it hard to take roots again.

IMPACT ON VARIOUS SECTORS

- Indian Economy:

Demonetization has made most of the transactions to be carried via the formal banking sector which has consequently resulted in increase of transparency with people and corporate paying tax properly. As per the report of Income Tax department, individuals paying income tax has increased to 28% from 4%.

The Central Statistics Office has expected India’s growth rate at 7 per cent for the current fiscal, 7.3 per cent for fiscal year 2018 and 7.7 per cent for fiscal year 2019. While the Reserve Bank of India (RBI), the Economic Survey and the International Monetary Fund (IMF) had projected India to grow at 6.9%, 6.5% and 6.6% in current fiscal respectively.

Further, demonetization measure helped banks to recover some bad loans and improve their financial position.

- Kind of economy:

Attempted to create a cashless economy. While ATM transactions have remained constant at around 700 million, Debit card transactions rose from 817 million (last year) to more than 1 billion in January.

- Gold Purchase:

Sales of gold increased on 9 November, with an increased 20 to 30% premium surging the price as much as ₹45,000 (US$700) from the ruling price of ₹31,900 (US$500) per 10 grams (0.35 oz).

- Businesses in India:

By the second week after demonetization of ₹500 and ₹1,000 banknotes, cigarette sales across India witnessed a fall of 30–40%, while E-commerce companies saw up to a 30% decline in cash on delivery (COD) orders.

- Common Man:

Common people did not had immediate access to enough money to pay for their daily needs and health emergencies. Also, real estate prices fell, a lot of cases came forward where poor and people lost their life, standing in long queue. Around 85% people in India are unaware of cashless transactions, so for them online transactions were very hard to handle.

Further, the social impact was drastic especially with marriages which faced severe issues with cash transactions in marriages. A large number of people conducting produce the marriage invitation to withdraw 2, 50,000 and above. It has resulted in great hassles among the public.

- Banking Sector:

In the first four days after the announcement of the step, about ₹3 trillion (US$47 billion) in the form of old ₹500 and ₹1,000 banknotes had been deposited in the banking system and about ₹500 billion (US$7.8 billion) had been dispensed via withdrawals from bank accounts, ATMs as well as exchanges over the bank counters. The banking system has handled about 180 million (18 crore) transactions in the initial four days.

- Education sector:

Cash was the root cause of many problems and demonetization coupled with the push for digital payments is a step in the right direction to eradicate this menace by increasing financial transparency and competition among schools and universities.

As far as education sector is concerned a lot of black money has been retrieved by the IT department from the educational institutions which was received as donations for admission of students.

- Poor and illiterate:

Demonetization has led to major harassment of poor, illiterate. India has a literacy rate of 63.82% and around 85% people in India are unaware of cashless transactions, so for them online transactions were very hard to handle.

- Jobs:

As per the latest economic survey around 87% of India population is either self-employed or employed in unorganized sector. As a consequence of demonetization, many lost their jobs, particularly in the unorganized and informal sector and in small enterprises. Labor union jobs were also crashed.

Also, as far as salaried class is concerned, they faced a major problem in withdrawal of money due to the fixed limit for the same. ATM withdrawal limit was Rs 2000. They stood in queues to get money along with devoting a lot of time for the same.

- Healthcare:

Demonetization hit healthcare access in a significant way as it was common for people from all economic sections of the society, to pay their hospital expenses by cash. Due to demonetization nearly 70-80% of door-step services in health care industry like home care and diagnostics were affected. As the patients were not able to pay the exact change for these services, they just cancelled their appointments with respect to diagnostics.

Also, hospital refused to accept the old currency. The issue came into light when hospital administration in Bengaluru refused to accept the old currency to retrieve Union Minister Mr. Sidharamaiah brother’s dead body.

The common man faced severe issues transacting in the hospitals with old currencies. Further, several cases of death have been registered for not attending the patients as a consequence of demonetization.

- Politicians (Political Impact):

The sentimental speeches against black money made by Prime Minister drew huge crowds and his bold step of demonetization turned into vote banks for BJP. Opposition criticized the cash withdrawal limit of Rs 2000 from the ATM. Even Dr. Manmohan Singh expressed his dissenting view in this regard.

In the run up to the assembly elections in Uttar Pradesh, Punjab, Goa and Uttarakhand, demonetization’s announcement had came as a shock and awe for the political parties and politicians for whom black money is a lifeline. Hence, it helped make the election process clean and transparent.

- Black money:

Black money in Swiss banks remained safe after demonetization to a great extent. The money being in terms of foreign currency (USD$), so after the demonetization measures are over, the money can be exchanged back to Indian currency (newly published notes).

But as per the recent reports of December 2016, the Swiss bank may share the information regarding black money to the government.

Further, as per the latest UN Report, the Central government’s demonetization measures did not impede future black money flows in new denominations.